The New 2019 CMHC First-Time Home Buyer Incentive

Table of Content

The First Time Home Buyer Incentive program could be very beneficial for certain individuals. It is meant to be used by home buyers in areas where real estate market prices are reasonable. This program is also meant for home buyers with under $120,000 of income total. This incentive program is in partnership with CMHC, a mortgage insurance provider, and the Government of Canada. CMHC, Canadian Mortgage Housing Corporation, is a crown corporation.

A higher down payment is required if the price of the property is between $500,000 – $999,999. The minimum down payment is 5% of the first $500,000 of the property price and then increases to 10% for the remaining. There are a few requirements that you’ll need to meet before you can apply for mortgage default insurance. CMHC or Canadian Mortgage Housing Corporation is a government financial institution that guarantees a loan with the bank at a premium.

The First Time Home Buyer Incentive Program – What It Is

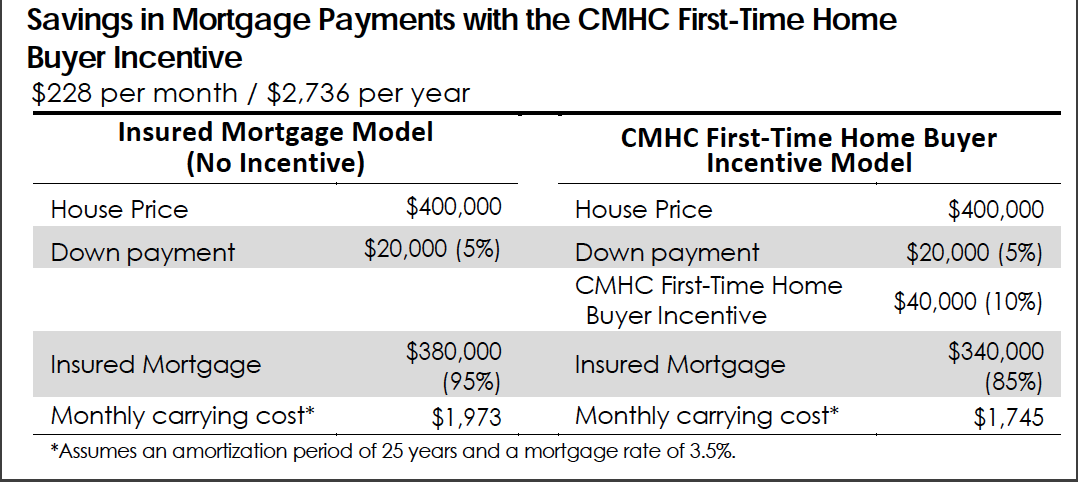

“It provides an option for those who already qualify, in very specific parameters, to reduce their monthly payments at the tradeoff of home equity,” he said. If you are a first-time home buyer looking to buy an already existing home, you will be provided with an incentive of 5%. If you are looking to purchase a newly constructed property, the CMHC First-Time Home Buyer Incentive will offer up to 10% of down payments.

This program better suits those living in areas of Canada outside of the major urban markets. The household’s income must be under $120,000, or $150,000 if you live in a Census Metropolitan Area , such as Toronto or Vancouver. Below, we break down all the key details of how the incentive works and who it is right for.

What do you need to qualify for CMHC?

It can be tough to gather the funds needed for a down payment and all the closing costs that come with buying a home. But programs such as the First-Time Home Buyer Incentive can help make homeownership a reality for many Canadians. Under the FTHBI, the borrower must repay a percentage of up to 8% of the home’s current value. For example, let’s say you borrowed 8% ($40,000) of a $500,000 house through the FTHBI, and then decide to sell the house 5 years later for $550,000. You’ll have to repay 8% or $44,000 when you sell your home. While the CMHC will have a piece of home buyers using this program’s profits, in the short term, it definitely helps with home affordability.

The mortgage and incentive amount together can’t be more than four times the household income (4.5 times if the home is in a CMA). Buyers must have a down payment of at least 5% of the total purchase price. If you don’t have your 20% down payment ready now, don’t worry! There is a way you can still buy your house – with the help of mortgage default insurance. Where the home’s value has depreciated, the Incentive minus a maximum loss of 8% per annum on the Incentive amount from the date of advance to the time of repayment.

Eligibility Requirements

This means that the government owns a shared investment with you as far as your home is concerned. This means that ups and downs in property value also affects the government. By putting down extra money toward your down payment, it can help to lower monthly mortgage payments, while potentially enabling home buyers buying a property below ~$500,000 to better afford a home. In exchange, the government gets an equal stake in the home’s equity, sharing in future gains or losses in value until the loan is repaid after 25 years or when the home is sold. If they contributed 5% of the purchase price when it was purchased, they get 5% of the purchase price when it sells.

If you’re looking to take advantage of the government’s First Time Home Buyer Incentive program, talk to your mortgage broker or REALTOR. 5 years from now, you sell the home for $805,000 and give CMHC 5% of the sale price ($40,250 in this example). If you were to sell the home at a loss, for example, $600,000, you would give CMHC $30,000 (5% of the sale price).

Want to quickly know if you qualify?

Before the application process begins, we want to bring everyone up to speed on what this incentive entails and how first-time homebuyers can benefit. From day one, the First-Time Home Buyer Incentive had its critics. The figures showed that homebuyers in Edmonton participated in the program more than any other city by a long-shot, at 1,288 successful applications, with Calgary a distant second at 636 applications. Toronto had just 39 homebuyers qualify for the program to date, while Vancouver saw nine and Victoria had just five.

It is done with a “shared equity program” where the CMHC will provide 5% or 10% toward a new home buyer's down payment. Related

However, it definitely helps you with affordability, especially on mortgage payments. The funds must be fully repaid by the time the first insured mortgage reaches 25 years or the house is sold, whichever of the two occurs first. Should homeowners be able to save up enough to pay back the amount early before either one of the two scenarios occurs, no prepayment penalty will be charged. The mortgage + the FTHBI cannot be more than 4x total income (Mortgage-to-Income Ratio).If household income is maxed at $120,000, theoretically the max.

There are no up front $ costs for the program, however, it is definitely not free. Think of it as if the government is making a shared investment in your home. Home buyers who utilize this program must pay back the CMHC either 25 years after their purchase or once the home sells. For home buyers that purchase a home that already exists (i.e. resale), a FTHBI of 5% will be available for those eligible. For the purchase of a newly constructed property, a FTHBI of up to 10% will be available for eligible first-time home buyers.

Stylized as FTHBI, the main aim of this program is to help improve affordability levels for Canadian citizens buying a home for the very first time. When you apply for a Loans Canada service, our website simply refers your request to qualified third party providers who can assist you with your search. Loans Canada may receive compensation from the offers shown on its website. To qualify for the FTHBI, applicants must have an annual income of no more than $120,000 and $150,000 in Vancouver, Toronto or Victoria. To be eligible for the First-Time Home Buyer Incentive, the house you wish to purchase must be located in Canada and be your main residence (i.e. you’re able to live there all year).

Also, the government shares in the market rise and fall of your home. The first-time homeowners incentive is not for everybody living in Canada. To qualify for this program, you have to fulfil the following criteria.

A participant’s insured mortgage and the incentive amount cannot be greater than four times the participant’s qualified annual income. I'm hesitant to do the 2 rooms that aren't done yet because I don't want to waste money on them that could be spent on the down payment toward the house. I'm considering calling the county real estate dept. in the morning to see if they can help in anyway.

Comments

Post a Comment